Embracing Cryptocurrency Transactions for Businesses

4 min read

The evolution of payment methods has witnessed a paradigm shift with the advent of cryptocurrencies. In today’s dynamic market, businesses are constantly seeking innovative ways to optimize payment systems, providing seamless, secure, and efficient transactions for both merchants and customers. This comprehensive exploration delves into the realm of cryptocurrency transactions, comparing them with traditional fiat transactions. From understanding the differences between legal tender and cryptocurrencies to analyzing mainstream currency types, exploring centralized and decentralized systems, dissecting transaction processes, and discussing factors like transaction speed, privacy, volatility, advantages, and disadvantages, this article aims to provide a holistic view of cryptocurrency adoption for businesses. Additionally, it will emphasize the importance of timing and conclude with a thoughtful reflection on the future of payment methods in the digital era.

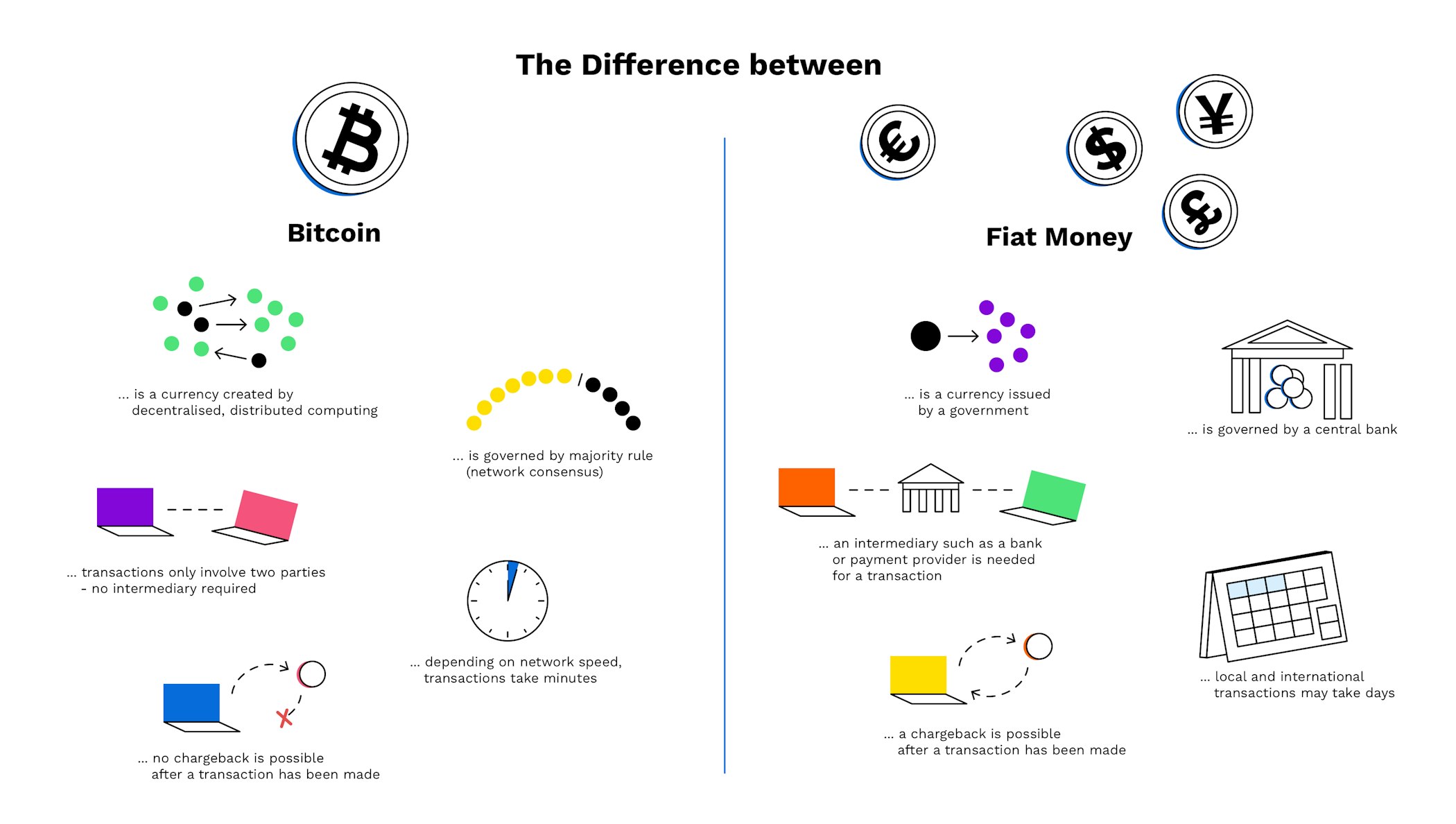

I. Legal Tender vs. Cryptocurrency Transactions

- 1.1 Understanding Legal Tender

- Defining legal tender and explaining its role as government-issued currency widely accepted for transactions, taxes, and debts within a specific jurisdiction.

- 1.2 Introduction to Cryptocurrency

- Providing an overview of cryptocurrencies, digital or virtual currencies secured by cryptography, and their decentralized nature, enabling peer-to-peer transactions without the need for intermediaries like banks or governments.

II. Mainstream Currency Types and Their Role in Transactions

- 2.1 Fiat Currencies

- Exploring widely used fiat currencies like the US Dollar, Euro, and Yen, discussing their stability, acceptance, and impact on global trade.

- 2.2 Major Cryptocurrencies

- Introducing popular cryptocurrencies such as Bitcoin, Ethereum, and Ripple, highlighting their market dominance, unique features, and potential for disrupting traditional financial systems.

III. Centralization vs. Decentralization in Transactions

- 3.1 Centralized Systems

- Discussing traditional banking systems and online payment platforms, emphasizing the centralized control, security measures, and limitations of these systems.

- 3.2 Decentralized Systems

- Exploring blockchain technology and its role in enabling decentralized cryptocurrency transactions, emphasizing benefits such as enhanced security, transparency, and censorship resistance.

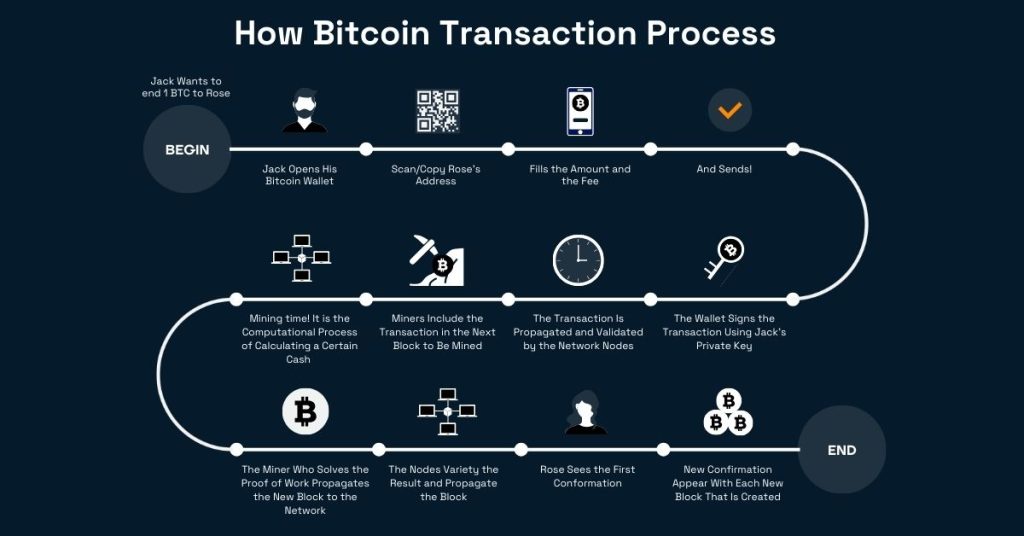

IV. The Cryptocurrency Transaction Process

- 4.1 Wallet Creation and Security

- Detailing the process of creating cryptocurrency wallets, ensuring security measures such as private keys and two-factor authentication to safeguard digital assets.

- 4.2 Initiating Transactions

- Explaining the steps involved in initiating cryptocurrency transactions, including selecting recipients, specifying amounts, and authorizing transactions through digital signatures.

- 4.3 Confirmation and Record-Keeping

- Describing the confirmation process involving miners validating transactions, ensuring network consensus, and recording transactions on the blockchain ledger.

V. Transaction Speed and Settlement Time

- 5.1 Cryptocurrency Transaction Speed

- Analyzing the rapid transaction speeds of cryptocurrencies, allowing for instant transfers, especially for peer-to-peer transactions and cross-border payments.

- 5.2 Settlement Time Comparison

- Contrasting cryptocurrency settlement times with traditional banking systems, emphasizing the efficiency of cryptocurrencies in processing transactions within minutes, compared to the potential delays in conventional banking.

VI. Privacy and Anonymity in Cryptocurrency Transactions

- 6.1 Privacy Features

- Exploring privacy-focused cryptocurrencies and their advanced features such as confidential transactions and stealth addresses, ensuring enhanced privacy for users.

- 6.2 Anonymity Considerations

- Discussing the nuances of anonymity in cryptocurrency transactions, addressing common misconceptions and highlighting the importance of responsible usage and compliance with regulations.

VII. Volatility and Cryptocurrency Value

- 7.1 Volatility Challenges

- Acknowledging the inherent volatility of cryptocurrencies, discussing factors contributing to price fluctuations, and exploring strategies to mitigate risks for businesses.

- 7.2 Store of Value and Investment

- Exploring the role of cryptocurrencies as a store of value and investment assets, examining the growing acceptance of cryptocurrencies as legitimate investments in diversified portfolios.

VIII. Advantages and Disadvantages of Cryptocurrency Transactions

- 8.1 Advantages

- Enumerating the advantages of cryptocurrency transactions, including lower transaction fees, enhanced security, global accessibility, financial inclusion, and potential for innovation in various industries.

- 8.2 Disadvantages

- Addressing the challenges associated with cryptocurrency transactions, such as regulatory uncertainties, technological barriers, scalability issues, and susceptibility to cyber threats and fraud.

IX. Timing Is Everything: The Crucial Role of Opportunity

- 9.1 Market Timing

- Emphasizing the significance of market timing in cryptocurrency adoption, discussing factors such as market maturity, regulatory developments, and technological advancements influencing the optimal timing for businesses to embrace cryptocurrencies.

- 9.2 Strategic Implementation

- Providing insights into strategic implementation strategies for businesses, including pilot projects, partnerships with fintech companies, and gradual integration of cryptocurrency payment options based on market conditions and customer demand.

X. Conclusion: The Future Landscape of Payment Methods

In conclusion, the evolution of payment methods continues to shape the global economic landscape. Cryptocurrencies, with their decentralized nature and innovative technology, offer unparalleled opportunities for businesses seeking to optimize payment systems. However, embracing cryptocurrencies requires a nuanced understanding of their advantages, challenges, and the crucial element of timing. By carefully weighing the benefits against the risks, staying informed about regulatory developments, and strategically implementing cryptocurrency solutions, businesses can position themselves at the forefront of the digital payment revolution. As the digital era unfolds, the convergence of traditional finance and cryptocurrencies will define the future landscape of payment methods, offering businesses unprecedented possibilities for growth, efficiency, and global reach.